Filed by the deadline but still not seeing that refund in your bank account? You’ are probably not alone. Many taxpayers eagerly await their refund each year, but sometimes the process can take longer than expected. Below I am covering several common reason for delays in getting that tax refund, and I also lay out what you can do to track your refund status.

Common conditions that slow down the process:

- Errors on your tax return:

One of the most common reasons for a delayed refund is errors on your tax return. This includes mistakes in your social security number, incorrect bank account information, or incomplete information. If the IRS finds errors on your return, they will need to contact you for clarification, and the IRS does this via snail mail. - Fraud prevention measures:

The IRS has implemented fraud prevention measures to protect taxpayers from identity theft and refund fraud. These measures can include additional identity verification steps and more thorough reviews of tax returns. While these measures are important for your protection, they can also cause delays in processing your refund. - Timing of your tax return submission:

We have heard it before. Timing is everything. If you file early in the tax season, you may receive your refund sooner than if you file later. However, if you file close to the tax deadline or during a peak processing time, such as after a tax law change, your refund may take longer to process.This was a year of very heavy last minute filing. Why? Is it due to the deadline being moved off for the past few years? That is our thought… Nonetheless, the IRS and state departments will be backed for some time due to the massive influx of last minute returns. Best advice here? File early next tax season to avoid the rush!

- Bank processing times:

If you chose to receive your refund via direct deposit, it’s important to note that processing times can vary depending on your bank. Some banks may take longer to process direct deposits, which can delay the time it takes for your refund to appear in your account.

What can you do to track your refund status?

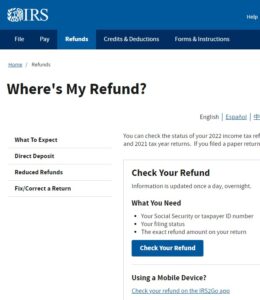

You need not call your friendly tax professional each time to ask about your refund as the tools are readily available for each of us to use at our convenience. The best way to track your refund status is by using the IRS’s “Where’s My Refund?” tool. This online tool allows you to check the status of your refund by entering your social security number, filing status, and refund amount. The tool will provide you with the status of your refund, including if it has been approved and when you can expect to receive it.

If you don’t have access to the internet or prefer to speak with someone directly, you can also call the IRS’s refund hotline at 1-800-829-1954. Be prepared to provide your social security number, filing status, and refund amount when you call.

Each state also has a “Where’s your Refund” look up tool as well. Click here for Connecticut Refund tool.

What about next Tax Season?

The biggest thing to learn from the delays after filing is this: The earlier you file, the better chance you have for a quick turn around. Of course it is always important to double check your entries as well!

And for those who do not get a refund, but wish you did? That is where a little tax planning or Pay Stub Check-up come in! I offer free consults where we can go over both of these at any time throughout the year. Make an appointment and we can chat!

Questions? Concerns? A topic you would like covered here? Send me a message and I will get back to you as quickly as I can!